VCAAP Terms and Conditions

If you received a VCAAP grant award, review the VCAAP terms and conditions. Make sure to deposit your award check by December 30, 2020.

Sign up for our newsletter to receive updates!

Frequently Asked Questions

-

General Information

- Registration, Username, and Password

-

Other Federal Assistance

-

Agriculture and Working Lands Assistance Application

-

Dairy Assistance Application

General Information

I initiated my application prior to the November 15 deadline but did not submit it. Will I still be able to access my application?

The Dairy Assistance Application and Agriculture and Working Lands Agriculture Application closed on November 15, 2020. If you did not submit your application prior to the deadline, we cannot review your application for an award.

I am having trouble loading or saving the application. What web browser should I be using?

For best performance, please use the latest version of Chrome, Firefox, or Safari (on Mac OS) when you are working on the application.

Is there a paper application?

We cannot accept paper applications.

I have applied for grants through the Vermont Agency of Agriculture in the past. Is the VCAAP application available the WebGrants grant management system?

- The Dairy Assistance Application and Agriculture and Working Lands Application are available through the VT Economic Recovery Grant Salesforce platform.

- The Farmers' Market Relief Application is available through WebGrants.

- The Farm to School Application is offered jointly with the Agency of Education’s Child Nutrition Equipment Grant. Access the application form.

Can someone help me fill out my application?

For assistance with the application process, connect with a Vermont Farm & Forest Viability Program business advisor or refer to our list of Agriculture Business Support partners. The Farm Viability Program has a wait list for support at this time, so please reach out as soon as possible for assistance with your application. Note: You will need to share your unique identification number with a business advisor and ensure that you have all required documentation available for submission.

While someone can help you fill out your application, but your business is responsible for the application, must supply the information, and must attest to its accuracy. A third party can help you fill out the application if your business authorizes the third party to help. Applicants can also add additional contacts to the application (for example, your CFO, general counsel, or attorney); these additional contacts can access and edit the application with your permission and direction.

For all other questions, contact us.

Will the amount of my direct payment be released to the public?

Your business’s financial information will not be shared in response to a public records request, but your name and the amount of any grant payment will be disclosed if requested in a public records request.

Is my direct payment considered taxable income?

Grant payments received are taxable income, and each business that receives a VCAAP grant payment will receive a 1099-G for tax year 2020.

What if I applied for and received other State grants (like a Working Lands grant) that were not funded by federal Coronavirus Relief Fund (CRF) dollars. Does that affect my eligibility for VCAAP?

Funds you may have received from other state or philanthropic funding sources do not impact your eligibility for VCAAP. However, businesses cannot be paid twice for the same loss or expense. If you are covered by insurance or received a different federal or non-CRF State grant, you cannot ask to be paid through this program for the same loss or expense. However, you can apply to this grant program to cover any portion of your losses or expenses that were not covered by another program, and/or to cover different expenses or losses that were not covered.

Does receiving Pandemic Unemployment Assistance impact a business' eligibility for VCAAP?

Overall, receiving unemployment does not impact your eligibility to apply. Unemployment would not be considered a duplicative payment unless you’re using unemployment funds to pay for things you would be claiming in this application, such as if you were to claim wages for time working on your business’ recovery as an expense in the application.

Do I need a profit and loss statement for each month of 2019 and 2020 if I am applying only for financial assistance for expenses due to COVID-19 and not for lost revenue?

If your business is only applying for additional expenses you do not need to supply the profit and loss information.

If there was only one month where my business took a loss due to COVID-19 for an event my business was supposed to attend, do I need to supply a complete year of Profit and Loss statements?

If you are claiming any revenue reduction, you must provide full year 2019 and year to date Profit and Loss statements.

What happens after I submit my application?

Your application will be added to the queue and reviewed in the order it was received. A VAAFM staff member will reach out to you at the contact information you provided if there are questions about your application. You will be notified of the decision as soon as possible.

When and how will I receive the grant money?

Your application will be reviewed in the order it was received. If your business is eligible and your application demonstrated losses or expenses related to the public health emergency, you can expect to receive a check via US Mail in 3 to 4 weeks. The Vermont Department of Finance & Management will issue checks.

How long will the application take to complete?

If you gather all of your relevant financial information before starting your application, you can anticipate completing your application in 45 minutes to 1 hour.

I see personal protective equipment (PPE) is eligible. What about signage, barriers, mobile/touchless payment processing?

If the applicant can make a direct connection to pandemic response or changes then it is an eligible expense.

Can I claim expenses related to the additional time I spent adapting my business to COVID-19?

You can enter expenses related to any additional time spent adapting your business to COVID-19 in the "other economic harm" section as long as you make a clear connection to pandemic response.

How will farmers know that they need to include other costs, such as shipping/selling animals, without working with a technical advisor?

Please review the recorded webinars, visit the application pages, view the Frequently Asked Questions, and use your best judgment. If you have questions, please contact us.

Registration, Username, and Password

How do I register for the Agriculture and Working Lands Assistance Application?

Complete the Agriculture & Working Lands registration form. Once you have registered, log in to access your application.

How do I register for the Dairy Assistance Application?

Complete the Agriculture Registration Form. Once you have registered, log in to access your application.

How do I find my Unique Dairy ID Number (Farmer/Processor ID Number) required for the Agriculture Registration Form?

The Vermont Agency of Agriculture sent each registered dairy producer and processor a letter via email and/or postal mail during the week of July 13, 2020. You can find your unique ID at the end of first paragraph of this letter. If you cannot find your unique ID number, contact us.

Note: You do not need a Farmer/Processor ID Number for the Agriculture & Working Lands registration form.

Is my username my email address?

The username you create during registration can be your email address or a username you create in the format of an email address.

Why is my username invalid?

Problems adding a username? Our application platform, Salesforce, allows a username to be registered only once. If you applied for another other state program using Salesforce (such as unemployment insurance or another VT Economic Recovery Grant), you may have already used your email address as your username. If so, try using another email address as your username.

What are the requirements for creating a password?

Your password must have at least 10 characters and include, at minimum, one letter, one number, and one special character (!@#$%^&*()_+-={}[]\|;:',.?/`~><").

How do I reset my password?

If you forget your password, click the Forgot Password button on the VT Economic Recovery Grant Login page to reset your password. If you cannot reset your password, please contact us.

Other Federal Assistance

I received a Paycheck Protection Program (PPP) loan, an Economic Injury Disaster Loan (EIDL) loan, or other federal reimbursement. Am I ineligible to apply for assistance?

You are not automatically ineligible. We recognize that other federal programs may only cover a portion of a business’s costs and/or lost revenues related to COVID-19 and designed these programs to provide support beyond what the federal programs provided. The key is that no business can receive any combination of aid or insurance that exceeds its actual costs for any specific loss or expense.

Does a loan–such as PPP or EIDL—that must be paid back count as aid that must be deducted from any State grant award for the same loss or expense?

Loans that must be paid back are not a duplicative grant payment and can be included in the VCAAP.

I applied for federal assistance and am waiting for a response. What does that mean for my application?

If you apply before you know what federal aid you might receive, then you must identify your pending federal requests when you apply for Dairy Assistance or Agriculture & Working Lands Assistance.

If I received a Paycheck Protection Program (PPP) loan to exclusively cover payroll, and I am not claiming payroll as an expense in my application, do I need to report the PPP loan?

No. You only need to disclose insurance or federal aid that relates to the same losses or expenses that you are claiming in your assistance application. If you are not seeking reimbursement for a specific loss or expense because it was covered by insurance or federal aid, then it is not relevant to your assistance application.

What if we have applied to CFAP and haven’t heard back yet?

If the applicant has applied for--but not yet received--CFAP payments, enter that your business has not received this payment. However, if your business receives payments in the future, the applicant will need to let VAAFM know to discuss how this will affect your application and VCAAP payment.

I received funding through the Coronavirus Food Assistance Program, or CFAP. Does that disqualify me for this grant?

You can still apply if you received CFAP payments. DAIRY PRODUCERS: If a dairy producer has received CFAP payment(s), they should mark the applicable checkboxes for each month they received payment, but not enter any CFAP payment amounts into the duplicative payments box. OTHER APPLICANTS: If you are claiming anything in the application that CFAP also covered, you'll need to enter the CFAP payment dollar amount into the duplicative payments box.

The Dairy Margin Coverage program is a risk management/insurance program and is not part of the federal CARES Act, so why does it impact this state grant program funded by the CARES Act?

The CARES Act created the Coronavirus Relief Fund (CRF), which funds this Vermont state grant program. Under the CRF, economic harm is not compensable if it is covered by insurance or other federal grants or programs. You can receive federal aid and/or insurance and still be eligible for a dairy grant, but you cannot be paid twice for the same loss or expense. The objective is to pay for necessary expenditures related to the COVID-19 pandemic—not to reimburse businesses for more than they lost.

Agriculture and Working Lands Application

My VT tax ID does not work in the application. Can I use my SSN or EIN?

The EIN is the correct next number to use. If this doesn’t work, please contact us.

What is a NAICS code? Where do I find mine?

The North American Industry Classification System (NAICS) is used by the United States, Canada, and Mexico to classify businesses by industry. Each business determines its six-digit NAICS code number based on an assessment of what constitutes most of its business activity. When you file your federal income taxes you provide a “business code” that is based on the NAICS number and the information for your business tax filing includes a table of those codes. On the application form, there is a drop-down menu to assist in your NAICS code selection.

Eligibility

Are maple producers eligible for the Vermont COVID-19 Agriculture Assistance Program (VCAAP)?

Maple producers are considered "non-dairy farmers" and are eligible for funding through the VCAAP Agriculture and Working Lands Assistance Application, provided they meet the other eligibility requirements. The business will also need to show losses or expenses related to the COVID-19 public health emergency to qualify for a grant award.

How do I determine my eligibility as a maple producer?

Do you tap trees? Do you process the syrup yourself? If yes to both, you will then apply as a farmer. If you buy sap that you do not tap yourself and process it into maple products, then you would apply as a value-added food product business. This distinction is important, as it changes the application questions that will appear.

Where do slaughterhouses fit in?

Commercial slaughterhouses and meat processors are included in the legislation that created the Vermont COVID-19 Agriculture Assistance Program (VCAAP) and are eligible for funding through the Agriculture and Working Lands Assistance Application, provided they meet the other eligibility requirements. Slaughter businesses working under an exemption are ineligible.

Are equine businesses eligible?

Equine businesses are eligible provided they meet the threshold eligibility requirements. An eligible equine business must raise, feed, or manage four or more equines which are owned or boarded by the farmer. In addition, the equine business must have earned at least $10,000 in gross revenue from the sale of horses or horse “products” (and/or from the sale of other “agricultural products”) in one of the two, or three of the five calendar years preceding submission of an application. Once an eligible equine business meets the minimum agricultural sales requirement, all of its losses or expenses since March 1, 2020 that are related to the public health emergency can be included in its grant application. As a related example, if an equine business meets the minimum sales threshold because it sold $10,000 in horses during the pertinent period, then it can apply and include its lost revenue from not being able to provide riding lessons because of the pandemic.

Are hemp businesses eligible?

If you grow hemp as an agriculture business, your business is eligible to apply.

We have a floral landscape design business and grow a lot of product on the farm. We have lost income due to wedding events being canceled. Is my business eligible?

Eligible sectors are defined on our website. The definition of farmer includes the “cultivation or other use of land for growing food, fiber, Christmas trees, maple sap, or horticultural and orchard crops.” If the products your business grows include horticultural crops, your business can apply in the agriculture business – farmer category.

Do I understand correctly that trade/producer associations are eligible under the same guidelines of revenue losses and/or expenses related to COVID-19? Would we use the same application?

Producer associations are eligible if they have not already received a state funded CRF grant.

Can a business headquartered in another state, with offices/facilities in Vermont, apply for VCAAP funds to recover economic losses/expenses to Vermont facilities?

Businesses with facilities in Vermont are eligible to apply, but only for losses for their Vermont-based business. Their revenue category will be verified by the Vermont tax return they provide, so they must select the revenue category (which determines the maximum award) based on numbers from that return and not the federal return.

What happens if more eligible businesses apply than there are available funds?

VAAFM will issue grants on a first come, first served basis until the available grant funds are exhausted. We can consider an application complete only if it has all the information needed to verify eligibility. For this reason, it is critical to ensure when you apply that you have all the required information to upload, and the information you type into the application is accurate. If your application ends up delayed because of inaccurate information or incomplete filing, it will not reserve your place in line for funds.

Can my business be in Chapter 12 bankruptcy and still be eligible?

We only require information about Chapter 7 bankruptcy for the purpose of this application.

Can you please explain what "final order" means in the eligibility criteria? Is this a farm that has formally been fined by the state and has not yet paid?

"Final order" depends on the facts and circumstances of a specific situation, as there are a variety of mechanisms that may exist in ANR and AAFM to get to a final order. In most cases, a final order in this context means that at the conclusion of its administrative processes the Agency of Agriculture or the Agency of Natural Resources (or any of its Departments) found a violation and issued an order that imposed a fine or penalty or some other action or corrective action. If there are questions around the status of a final order, we ask that you or others reach out to AAFM or ANR for the specific status.

What does it mean to be in good standing with the Vermont Department of Taxes?

For the Department of Taxes, good standing for your business means that all required Vermont tax returns are filed and that all Vermont taxes are paid, OR if you owe taxes that are past due, you are in a payment plan for those taxes. If you have unpaid business taxes, you can call (802) 828-2518 to request a payment plan. Taxpayers who are not in good standing with the Department of Taxes may be deemed ineligible for an Agriculture & Working Lands Assistance grant award.

What does it mean to be in good standing with the Vermont Secretary of State?

For the Secretary of State, good standing means a business can confirm a business is compliant with all legal requirements to retain sole rights to its business name, and the authority to conduct business under its business name within the State of Vermont. A Certificate of Good Standing is not required for an application.

Forestry & Dairy Business Eligibility

Can businesses that receive Forest Economy Stabilization Grant Program (FESG) grants from the Department of Forests, Parks and Recreation also apply for a Vermont COVID-19 Agriculture Assistance Program (VCAAP) grant?

A business may apply for more than one state grant funded by Coronavirus Relief Funds, but not for the same purpose or to cover the same costs.

Which types of forest products businesses are not eligible for FPR grants? Do you have some guidance on this so I would know if I can apply?

Please consult the eligibility requirements of the Forest Economy Stabilization Grant Program.

If a business was granted Vermont Dairy Assistance and listed more expenses in that application then were required, how do they know which expenses were used by the State to meet the cap for that grant so that they may use them for this grant?

A dairy applicant cannot apply for items covered under the VCAAP dairy application - generally milk losses, supply management fees, increase in feed/bedding costs, and other additional economic harm. If a dairy farm also produces maple syrup and did not apply for and receive funding for those losses, they can apply for maple in this application.

If a dairy farm caps out on the dairy relief program but still has outstanding losses due to milk price decline, can they apply to the Agriculture and Working Lands application for that?

If a dairy farm caps out on the dairy relief program, that dairy farm would not be eligible to apply for the Agriculture and Working Lands application for the same losses or additional expenses as claimed in their dairy application.

Is there a Dairy Processor exemption?

If you have applied under the Dairy Processor application and have other expenses that are not related to your Dairy processing business, you can apply under the same business tax identification number in this application. An example: A dairy that also raises pigs, could capture the losses for the revenue from the pigs on the Agriculture and Working Lands Application since they did not claim these losses on the Dairy Processor Application.

How long should it take for me to complete the application?

If you have your records on hand, the application can take as little as 20 minutes to complete. If you will need to digitize information or are less comfortable with technology, it might take closer to 2 hours. We encourage you to organize and digitize all of your information ahead of time for an efficient and successful application process.

If an entity is determined ineligible, or a question gets answered incorrectly so it seems they are ineligible, will the application let you know?

If you are deemed ineligible at any point in the application, a warning will pop up based on the answer just given that the business is ineligible. At that point, an applicant can still change their response or edit in the case that they have selected the answer in error.

I missed a scheduled webinar. Is there a recording?

Webinar recordings are located on the Agriculture and Working Lands Assistance Application webpage.

What if I don’t have a Federal Employer Identification Number (EIN)?

The question fields will appear based on the type of business you have selected. If you don’t have a Federal EIN, enter your Social Security Number (SSN) in the field.

What if I don’t have a Vermont Employer Identification Number (EIN)?

You are not required to have a Vermont EIN. If you do not have a Vermont EIN, leave the field blank. Do not enter a Social Security number or Federal EIN instead of a Vermont EIN. Instead, click “Add Company” and complete the pop-up form to add your business.

What if I don’t have a Vermont Secretary of State ID number?

You are not required to have a Secretary of State ID. If you do not have a Secretary of State ID or receive an error when you enter your ID, leave the field blank.

If we have not completed our 2019 income taxes yet, is a 2018 return acceptable?

If you have not completed your 2019 income taxes yet, your most recently completed federal tax return is acceptable.

If I applied for a Working Lands COVID-19 Business Development Response Grant, can I pull information in from that application, or do I need to start over?

This prior grant was a state-funded opportunity for forward-thinking COVID-19 response business development; the VCAAP Agriculture and Working Lands application uses Federal Coronavirus Relief Funds and is for reimbursing COVID-19 expenses and losses. They are separate funding opportunities, therefore your application to this grant is completely new and unrelated to the previous Working Lands grant application.

What does "drop files" mean? I have no files or receipts stored electronically. What should I do?

Use the "Upload Files" (or "Drop Files") button to upload your financial documents, receipts, or other requirement documentation in the application. The application will accept files in many electronic formats (Microsoft Word, PDF, JPEG, etc.).

If you do not have digital or electronic copies of your documents, you can:

- Take a picture with a smartphone or digital camera. Ensure that the image is clear.

- Scan your documents with a digital scanner.

Your local library may offer scanning services. Many printers and camera stores also offer scanning. Office supply stores like Staples and OfficeMax and shippers like FedEx and UPS can also scan your documents.

How is the payment amount calculated?

Payment amounts are based on the information the applicant provides. The payment amount is determined by the gross annual income category of your business, as required by statute. Your payment will not exceed that cap but could be lower depending on your unique situation.

During the review process, if an ineligible expense is identified, the review team will provide the applicant with an opportunity to adjust the answer.

How were the award tiers set? Wouldn't it have been better to have given caps of a set percentage of gross sales across the board?

All funding tiers and caps were statutorily created through legislation except for the $50,000 level, which was added by the Working Lands Board.

How are eligible amounts calculated within each revenue category? If your business income was within the $150K-250K annual revenue category, is the eligible amount pro-rated based on where you fall within the range?

The limits for the caps were set in statute by the legislature and the Working Lands Enterprise Board added the higher cap category for those who make $250,000, or more, annually. Each category cap is the maximum you can receive. If you show losses or additional expenses exceeding your cap, then you will receive the cap and if you show losses that are below the cap, then you receive the actual amount requested. Awards are not pro-rated throughout the range.

What happens if more eligible businesses apply than there are available funds?

The Vermont Agency of Agriculture, Food & Markets will issue grants on a first come, first served basis until the available grant funds are exhausted. We can consider an application complete only if it has all the information needed to verify eligibility. For this reason, it is critical to ensure when you apply that you have all the required information to upload, and the information you type into the application is accurate.

If my application was complete prior to October 1, 2020 is there anything additional that I need to do?

If you submitted it prior to the November 15 deadline, it is in the queue for review. If any changes are needed you will receive an incomplete notification with instructions on what to do in order to finalize your application.

Will businesses that have already applied for Agriculture and Working Lands Assistance VCAAP funding be able to reapply or amend their initial application?

If a business already submitted an Agriculture and Working Lands Assistance application that business will not be able to reapply, even if they have not hit their funding cap.

When should my business expect my Agriculture & Working Lands Assistance Application to be approved and processed?

The applications are reviewed in the order they were received. Processing time depends on the number of errors in the application, how quickly the applicant resubmits, and if they have corrected all of the errors.

When should my business expect an award once my application has been approved and process?

Approved applications move through payment weekly. It generally takes 7-14 days to receive a check in the mail.

How will “net business profit” be determined in the Agriculture and Working Lands Assistance Application?

Applicants should total their business’s profit between March 1, 2020 and August 1, 2020 and subtract expenses. If the number is positive, the business has a net profit. Net profit indicates that a business's total revenue has exceeded its total expenses during that period. If there is a net profit between March 1, 2020 and August 1, 2020, a business will not automatically be deemed ineligible, but additional eligibility criteria may need to be satisfied. Net business profit will be defined in the application. Please consult a business advisor if you have further questions.

How is net profit calculated in the application? CSA farms accrue income early in the year, but don't provide the service until later. Cash vs. accrual accounting would produce very different results.

Farmers have to show gross annual income of at least $10,000 in Agriculture and Working Lands Assistance Application. Net profit can be shown in cash or accrual accounting as long as it is consistent throughout the application. Need help figuring out whether you had a net profit? This worksheet can help.

Do applicants have to prove "no net profit" to be eligible?

Applicants will have to provide documentation to show whether their business had a net profit for the period of March 1 to August 1, 2020 if that business is claiming a revenue loss. A net profit will not automatically make a business ineligible, but additional eligibility criteria may need to be satisfied. If a business is not claiming revenue loss, the applicant will just need to fill out the Other Economic Harm section of the application. Need help figuring out whether you had a net profit? This worksheet can help.

What can I claim as economic harm due to the COVID-19 public health emergency?

Think holistically about the ways the pandemic has impacted your business. As long as you have documentation of the expenses and how they relate to the public health emergency, it will be considered in the review process.

What about changes to markets and other business expenses related to the COVID-19 public health emergency? For example, if I had to purchase a delivery vehicle or an online ordering platform to pivot to more direct consumer sales?

In the application, there will be an opportunity for you to submit all expenses related to the COVID-19 public health emergency for review. You should demonstrate the expense and explain how it relates to the COVID-19 public health emergency. Reviewers will review and consider your related claims.

Are expenses related to infrastructure improvements for a pivot in sales channels (i.e... farm stand construction/improvement) considered eligible expenses?

If the applicant can make a direct connection to pandemic responses or changes--infrastructure or otherwise--those expenses are considered eligible.

If we got a lower price for our syrup (or other product) this year but produced about the same amount, is this what we would claim as a loss?

Losses related to lower market prices will be captured in the Revenue section of the application where you submit your profit and loss statements from 2019 and 2020.

Can we claim loss of income from stores that have closed that carried our farm products?

In the application, you are asked to document overall changes in gross revenue between 2019 and 2020, not losses from specific markets/sales outlets. Gross sales is defined by total sales amount before deducting cost of goods sold. Please upload a profit and loss statement to demonstrate your losses.

If a business increased production of livestock this summer to meet increased demand, are those expenses eligible for this program?

If a business purchased more animals to meet market demand, those additional expenses can be claimed.

My business cannot obtain a timely slaughter date in Vermont due to bottlenecks associated with COVID-19. We have to make alternate plans for slaughtering and are considering taking our animals out of state for slaughter. Are these expenses eligible?

If your business has increased processing costs associated with needing to go to a different facility, your business can claim the difference between 2019 slaughter/processing costs and 2020 costs. This includes the difference in mileage for traveling.

My business is unable to get our animals slaughtered, meaning my business will incur costs to feed those animals through winter until I can either secure a slaughter date in 2021 or ship them out of state to have them slaughtered. Are these expenses related to holding animals eligible for this program?

If a business bought or raised animals with the anticipation of processing for fall/winter sales and then could not get a slaughter date and now needs to feed the animals over the winter, they need to show feed costs for 2019, purchase feed for 2020, and then can claim the difference. If the business never overwinters animals, the applicant needs to show proof of that (e.g. Profit & Loss statement with no feed purchases for winter months in previous years) in order to claim all additional incurred feed costs in the application.

If my business lost revenue because a farmers market was canceled early in the year but then the market reopened later in the summer (when it was too late to start crops to sell), would that be an eligible loss?

The lost revenue in this situation will be captured in the overall 2019/2020 sales comparison in the Revenue section of the application.

Would loss of sales due to crops unable to be harvested and maintained due to COVID-19 related issues count as losses?

If your business sold crops in 2019 this should be illustrated in the revenue loss table of the application. If your business had contracts to sell crops that were canceled (and did not sell these items in 2019), the applicant can claim those losses in the Other Economic Harm section.

Most of our income is from festivals that have been canceled. How do we document this?

To be eligible for reimbursement for lost revenue for canceled events under this program, the event must have been canceled by another party, such as a state governor or the event organizers (not just your business electing not to attend). In the Other Economic Harm section of application, upload proof of event cancellation by a third party and demonstrate proof of income you would have made as a result of the event (e.g. income from that event in 2019).

If the festival was changed to be virtual, does that mean we can’t claim a loss?

We cannot pay for projected revenue losses for an event that will still take place in a virtual format outside the months (March 2020 – August 2020) captured in the Revenue section of the application. Sales through a virtual event could still take place, so a projected loss in revenue would not be eligible (only actual losses are eligible). If the virtual event already took place between March and August 2020, changes in revenue from 2019 would be captured in the Revenue section of the application.

Our sales increased from 2019, but we have really had to pivot dramatically based on the new demand. As a business, we’re not showing much loss, but we do have significant expenses. Will I be able to claim expenses?

We know that many businesses are profitable this year but are also able to show economic harm for other reasons. If you do not have sales losses but have expenses, you can skip the sales section of the application, and simply fill out the economic harm section. Consider the ways that your business has responded to the pandemic based on the State and Federal guidance, which may have caused restrictions on operating your business – just reflect and report back on the increase in your operating budget. Examples could include a web platform introduced, credit card fees associated with e-commerce, etc.

If some of my COVID-19 response work (e.g., building an online sales system) was done by a friend, do they need to create an invoice, or can they just describe the work they did?

The claim would be strongest if a copy of a cashed check was included showing the amount paid, or an invoice from the person showing the work completed and amount paid.

What documentation is needed to show increased labor expenses due to COVID-19?

If the hours are above and beyond what a would have been the cost in 2019, the applicant should show the difference in wages (2019 to 2020) to account for the additional labor hours. If it cannot be captured in that way, a narrative explaining the time spent on the specific work (eg. surface cleaning) with the hourly wage will suffice.

How should I document extra hours that I worked because of the COVID-19 public health emergency?

We encourage applicants to upload a Word document that details any additional time employees have worked over their normal schedules (because of COVID-19). This should include a description of the work, the number of hours per week or month spent on the work, and a reasonable hourly pay rate.

- Example 1: A business that normally produces and sells wholesale but shifted to packaging products into individual bags for market sales.

- Example 2: Childcare due to COVID-related school closures – paying a sitter or using additional employee time for childcare so farm work can continue.

A business that has relied heavily on local volunteers for their fall production is now not able to do so; they will now need to hire people. How should this be documented?

Include documentation of labor hours provided by volunteers in 2019 that now need to be paid for, proof of no longer being able to receive volunteer support, and documentation of expenses shown related to hiring and paying people this year. For any cost to be considered, it has to be documented and verifiable.

Can I claim revenue losses in only a certain area of my business (e.g. sales to a certain market) if my overall 2020 gross revenue is greater than 2019 gross revenue?

If each part of your business operates under one TIN/EIN, you must upload the profit and loss for the whole business, not just the loss/gain of one portion or market. Additional expenses/economic harm can be claimed across different components of the business. Economic loss must only be captured in one place in the application; if sales losses are entered in the Revenue section, they cannot also be entered in the Other Economic Harm section.

Is there a place in the application for "other" where I can explain losses and/or expenses that are not included in the pre-existing drop-down menu and upload supporting documents?

You will have the ability to describe all losses and/or expenses that relate to the COVID-19 public health emergency. VAAFM will review your claims and determine whether you demonstrated necessary explanation for expenditures related to the pandemic.

Do I need to submit full Profit & Loss (P&L) statements? Are accounting documents showing change in gross sales acceptable?

Standard financial statements, whether a Profit & Loss, or something different, are required.

If we use QuickBooks, should we upload a whole profit and loss report (in the revenue section), or make a more abbreviated spreadsheet instead?

It is preferable to use a report generated by QuickBooks. Using a profit and loss statement for the whole year, broken out by month, is ideal (rather than each month separately).

Please explain what it means for expenses to be for a “different purpose” or “not duplicative” if my business is applying for multiple Coronavirus Relief Funds. (eg. ACCD and VCAAP Dairy) What are some examples?

If your business applied for an ACCD or Forestry relief program, which are 100% revenue based, your business cannot then also apply for revenue losses in our VCAAP programs. However, your business is able to apply for Other Economic Harm expenses such as PPE, marketing expenses, or implementing new practices for consumers.

If a dairy farmer applied under the VCAAP Dairy Assistance application and now wants to apply under Agriculture and Working Lands Assistance Program, that business cannot include any dairy-related expenses or lost revenues but can include claims from other enterprises (maple, pumpkins, farm camp).

The key is that the same loss/additional expenses cannot also appear on both applications.

Do you have an example to share of what the monthly sales documents look like?

To demonstrate monthly sales, you can use QuickBooks, Excel, or any other kind of standard documentation format; however, be sure to maintain consistency in the way you present the information in your application. If you are not able to export monthly income statements from your accounting system, you can use this Income Statement Template.

Dairy Assistance Application

September Milk & Revenue Losses

If you submitted an application with a preliminary estimate for September milk or revenue losses, you must finalize your application with your September milk check or documented September losses.

Dairy Farmers

To finalize September milk losses, follow these instructions:

- In the Milk Production Information table (Farm Detail), select the September production line.

- Enter your September milk price in the Federal Blend/Pay Price field.

- Enter your total production pounds in the Total Pounds of Milk field.

- For the Milk Check or Invoice upload, delete the Preliminary Estimate for Producers and upload your September milk check.

If this step is not completed, estimated September milk losses will be removed from your application.

Dairy Processors

To claim September losses, follow these instructions:

- Upload an income statement or profit and Loss statement for September 2020.

- Enter your actual September sales into the September 2020 COVID Sales field.

- Delete the Preliminary Estimate for Processors document and attach documentation of actual sales/losses.

If this step is not completed, the September loss of revenue and sales line item losses will be removed from your application.

October Milk Losses

If you submitted an application with a preliminary estimate for October milk losses, you must finalize your application with your October milk check and documented losses.

To finalize September milk losses, follow these instructions:

- In the Milk Production Information table (Farm Detail), select the September production line.

- Enter your September milk price in the Federal Blend/Pay Price field.

- Enter your total production pounds in the Total Pounds of Milk field.

- For the Milk Check or Invoice upload, delete the Preliminary Estimate for Producers and upload your October milk check.

If this step is not completed by December 1, 2020, estimated October milk losses will be removed from your application.

If your application does not include a line for October milk production in the Milk Production Information table (Farm Detail), include your October milk losses in the Other Economic Harm section using these instructions:

- Select Additional Loss/Expense.

- In the Price field, enter your claim for October milk losses using the following formula:

- January milk price - October milk price = price difference. Multiply the price difference by the total pounds of production, then divide by 100 for your total claim.

For example:

January price = $20

October price = $15

Difference = $5

$5 x 100,000 pounds of production = $500,000

$500,000 / 100 = $5,000

In this example, you would enter $5,000 in the Price field.

|

Jan. Price |

Oct. Price |

Jan. minus Oct. = State Rate |

Pounds |

State Rate x Pounds = Pounds of Production |

Pounds of Production/100 = payment |

|

$18.13 |

$16.15 |

$1.98 |

120,000 |

237,600 |

$2,376.00 |

|

|

|

|

|

|

Enter this payment amount in Other Economic Harm |

- For the Documentation upload, upload your October milk check.

- Select "Loss of market or consumer segment" under the Reason for Incurred Loss or Expense drop down list.

- In the Reason for Incurred Loss or Expense text field, enter "October milk price."

If this step is not completed by December 1, 2020, estimated October milk losses will be removed from your application.

Restarting a Dairy Business or Transitioning to Producing Another Commodity

If my dairy farm ceased operation after March 1, 2020, can I still apply? What does making a "good faith" effort to restart my dairy farm mean?

In general, dairy farmers and processors must have been operating on March 1, 2020 and still be operating to be eligible for a grant. A dairy farmer that ceased production after March 1, 2020 can be eligible for a grant if the farmer has a good faith plan to restart milk production or to produce another commodity. If you are a farmer who plans to restart operations, you will have to attest to your plan to restart by answering specific questions within the Dairy Assistance Application.

What does it mean to transition a dairy farm to producing "another commodity”?

For purposes of this application, “another commodity” means transitioning your dairy farm to producing another type of food or agricultural product.

Dairy Revenue Losses and Payments

How do I demonstrate my milk revenue losses?

You are eligible for milk price declines caused by the COVID-19 pandemic starting on March 1, 2020. To determine lost revenue, your milk price for March 2020 to the present is compared to the pre-pandemic January 2020 price. Milk is paid for in the month following production. You should start with your January 2020 milk payment, which you received in February. Use your pay price from the second milk check of each month that shows the total volume of milk for the prior month and pay price information. Milk price losses related to the pandemic are determined when you enter your milk price and production for each eligible month and compare it to the January 2020 price. For example, if the price declined by $5 per hundredweight since January, your monthly loss would be determined by multiplying five dollars times your milk volume.

Should dairy applicants enter all losses and costs even if anticipated to reach above and beyond the cap?

Yes, we recommend that an eligible dairy business enter all COVID-19 related costs and losses their business(es) have experienced since March 1, 2020 into their application.

What milk price are payments based on?

You will be prompted to either use the standard January 2020 pay price of $18.13 or to use your actual January 2020 pay price. You will also be prompted to include your pay price for all other months for which you are claiming a milk loss related to the COVID-19 public health emergency.

Where did the $18.13 pay price come from?

The Vermont Legislature used this pre-pandemic price in the legislation that created this grant program to evaluate milk revenue losses during the pandemic. The Statistical Uniform Price for January in the Middlebury location was $18.13. In most cases, prices subsequently dropped dramatically because of the COVID-19 public health emergency.

Can I enter my own milk price for January and not use $18.13 as the January price?

If you received a different milk price in January 2020, you may use the actual price you received to determine your actual losses in subsequent months. If you enter your own price for January and do not use the $18.13 price you will need:

- Your January 2020 milk price – the price you were paid for your January production. You received this check in February as the final check for the preceding month’s entire production.

You will need to upload this final check you received for your January milk to document the price you received.

- For all other months (potentially March to the present) for which you claim a milk price loss, documentation showing the total pounds of milk produced and the price paid for that milk in each month (e.g., April milk price corresponds to April production).

Please remember that the final check is delayed, so for March production and price, you will use the final check you received in April (some are marked as “final” or “final voucher”). You can also look for the time period indicated on the milk check to match the month you are requesting reimbursement for in the dairy assistance application.

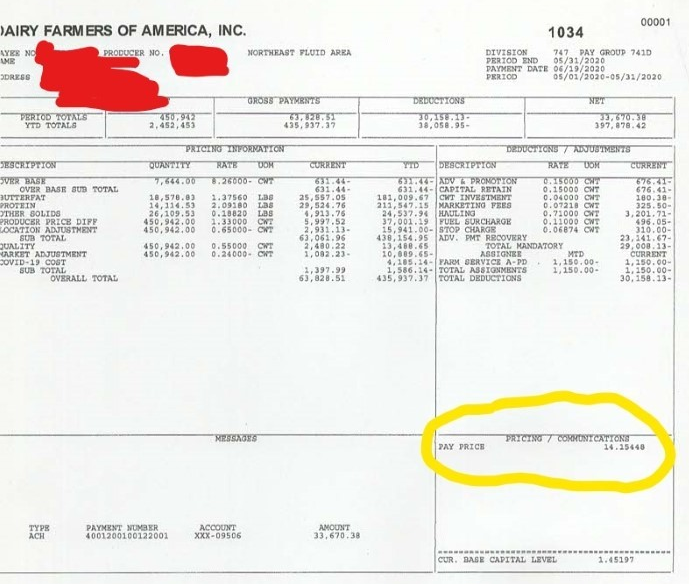

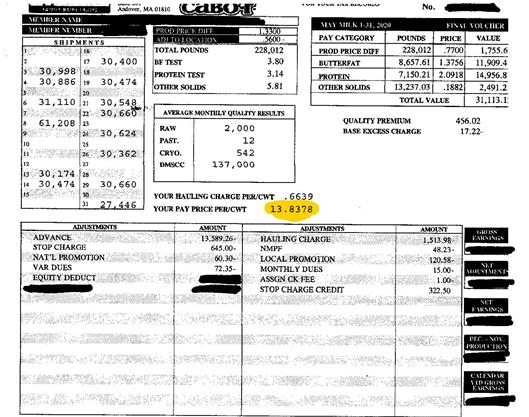

I am having trouble finding the correct information on my milk check. What number am I looking for specifically?

If you receive a milk check from DFA, look for the PAY PRICE number in the "PRICING / COMMUNICATIONS" box in the lower right-hand corner of your milk check.

If you receive a milk check from Agri-Mark, look for "YOUR PAY PRICE PER/CWT" located above the adjustments table.

At least one dairy cooperative offered a third milk check in June. How should this be referenced in my dairy application?

This should not be claimed by the applicant in this application. It does not need to be added to June's milk check amount per hundredweight and it is not deemed a duplicative payment. Therefore, this should not be added to the Dairy Assistance Application in any way.

Some dairy cooperatives included an actual COVID-19-related surcharge line item in their April milk check, how should this be captured in the Dairy Assistance Application?

This is a COVID-19-related expense that can be claimed in your application. Depending on how this surcharge is included in your milk check, this loss can be included in Other Economic Harm or be included in the milk table if included in the milk pay price for that month.

My milk checks from the past show a higher pay price, but now I owe the overpayment amount back and have a letter from the cooperative to this effect. How can I go about including this loss in my application?

Some cooperatives are calculating the supply management into the milk check. The application will need to claim the difference between the original 2020 price per hundredweight and the new adjusted price per hundredweight for the same month in 2020. This would be accompanied by Co-op verification on this change and why. The application could claim the new difference.

Example:

- January rate = $20.00/cwt.

- Original April = $16.00

- State payment rate = $4.00/cwt.

- Reduction of CFAP if required: - $2.53

New April Rate = $15.00

Extra claim for state dollars - $1.00/cwt. on milk volume for that month.

How are CFAP payments addressed if farm has multiple locations but only one Unique Dairy ID number?

The applicant should enter more than one farm for milk price and pounds table, check "yes" to CFAP for each of the milk price tables, and the CFAP deduction will be completed for each milk price table. The CFAP reduction is completed automatically once CFAP is checked on milk volume entered. There is no need to split out anything.

How are CFAP payments addressed if the farm has multiple locations and multiple Unique Dairy IDs?

When you enter each farm in your application and match each farm to their specific milk checks, please enter specific information for milk price and pounds related to the unique Dairy ID and location. If you check "yes" to CFAP an automatic reduction is made based on state payment rate on pounds entered.

For farmers with multiple Unique Dairy IDs, CFAP payments are not broken down between farms, so how do they capture their CFAP payment in their Dairy Assistance Application?

The CFAP payments are related to the volume of milk (per hundred weight) dairy operation included in their CFAP application. Therefore, you should not need to split out any farm location specific CFAP figures in your application; all will be managed based on per hundred weight volume calculations. If you represent multiple farms, once you check "yes" to CFAP in the application, then your deduction per hundred weight is accounted for in your application.

What documentation is available to demonstrate duplicative payments with other federal CARES Act funding?

- Dairy Margin Coverage: USDA FSA sent farmers a document showing this amount

- Dairy Revenue Protection Program: documentation from Crop Insurance Agent

- USDA Livestock Gross Margin – Dairy: USDA FSA sent farmers a document showing this amount (VERY few VT farmers use this one).

- PPP and EIDL - you only need to disclose insurance or federal aid that relates to the same losses or expenses that you are claiming in your dairy assistance application. If you are not seeking reimbursement for a specific loss or expense because it was covered by insurance or federal aid, then it is not relevant to your dairy assistance application and you may exclude it from your application.

Additional Losses and Expenses

Does a loss related to production limitations have to be dictated by a co-op, instead of a voluntary reduction in production?

Either type of production reduction can be eligible. However, to be eligible for reimbursement, all losses must be related to the public health emergency caused by the coronavirus. Each applicant will have to demonstrate how their losses are related to the pandemic, and the Agency of Agriculture’s reviewers will determine whether the claimed loss is compensable.

If my supply management is a voluntary reduction, is that still eligible for me to claim as a loss in my application?

It is the responsibility of the applicant to make the connection to how this voluntary reduction was associated with COVID-19. If deemed a valid association as a result of public health emergency, than the loss would be likely eligible.

I have been required to reduce the volume of milk I produce due to a supply management program. Can I claim the lost revenue due to less milk volume?

Yes, provided the reduction is related to the public health emergency and occurred since March 1, 2020. You will need to provide a dollar value and documentation to demonstrate your actual loss. The loss must be presented in the economic harm section of the application which only allows a single document upload per loss claimed. To demonstrate the dollar value please follow the below steps. You will need to save all required documents as a single word or PDF document and attach it to the line item.

Before you start to calculate, you will need your 2019 and 2020 monthly production records from your end of month milk check and the pay price you received in 2020 for that corresponding month’s milk. The 2020 pay price documentation is identical to what you used to document your 2020 milk price and production. Only the months from March through September of this year are eligible for reimbursement for any pandemic-related milk volume reduction. You can use the below table as a guide for the information we will need to calculate your allowable supply reduction claim:

The math:

- (2019 total volume by month in pounds) – (2020 total volume by month in pounds) = difference in volume;

- [(Difference in the volume) x (price per hundredweight)] ÷ 100 pounds = revenue change based on volume; and

- Add all numbers from the far-right “Revenue Change Based on Volume” column to generate your grand total.

In the economic harm section of the application, you will use the dollar amount in the “Total Revenue Change” box as your claimed losses.

Please upload all documents showing your 2019 volume per month and the above calculation table as a single file. We do not need 2020 files if you included them in the milk loss section (which you were required to do if you claimed milk price losses). Only the months of March through September are eligible for reimbursement.

How can over-quota charges for exceeding production levels be captured in the Dairy Assistance Application?

Over-quota situations are being managed differently by various cooperatives, so the applicant will need to explore how their situation is being uniquely handled:

- Some milk checks have a line item charge for over base production. That amount can be claimed with accompanying clear documentation of the over base penalty charge. Eg. If called out as an additional charge, you can document each charge by month and provide documentation for all claims since March 1, 2020.

- Some cooperatives are having a specific line item deduction but adjusting the pay price. There may not be clear math on the milk check stub to indicate this.

Example: Total milk produced in a month: 102,000 x $16.00/cwt = $16,320

Base pounds – 100,000 per month – paid at federal order rate: 100,000 x $16.00/cwt = $16,000

Over base pounds – 2,000 paid at highly reduced rate: 2,000 x $5.00/cwt = $100

Total payment ($16,000 + $100 = $16,100): $16,100 divided by total milk volume (102,000) = $15.78/cwt

In this example, the $15.78 pay price includes the supply management overage and would be your pay price compared with January 2020 in the milk table.

My dairy business was originally going to attend an event between October 2020 and December 2020 that was canceled prior to the end of September. Will those losses be eligible to submit as 'other economic harm' under my Dairy Application?

If an event planned for October-December 2020 was canceled prior to the end of September by a third party (Big E canceled, festival canceled by host, etc.) AND the dairy business has losses or costs associated with not attending that event, those losses are eligible for inclusion in this application as long as the same loss or cost has not been claimed and reimbursed for in another state, federal, or insurance program. The applicant will need to explain the losses and upload the documents that demonstrate the event losses in 2020 (due to the event cancellation) compared to the same event in 2019.

Grain prices have gone up and I am having trouble paying for grain. Can I claim this added expense?

- Third party verification stating that the price of the feed has gone up due to COVID-19. A grain company, feed provider and/or feed store may provide a written document to this effect.

- Written document should include pre-COVID-19 price and COVID-19 price at purchase; and

- Reason for increase is due to COVID impact

- Documentation showing how many tons were purchased between March and the month being claimed in your application. For example, if submitting your application in August, you may claim March through July in your current application. Documentation may be an invoice from feed company, sales receipt from feed store etc.

- Month-by-month claim – see chart below:

What if my farm has experienced huge losses due to being unable to sell their heifers as planned – both a loss and additional cost of keeping the heifers. What documentation would suffice to claim this loss and additional expense?

Applicant should provide documentation showing the following:

- How many heifers are sold each month in 2019 (e.g. P&L or income statement).

- Average $ value of heifers from 2019, utilizing similar documentation (P&L or income statement).

- Letter or other form of communication from farmer/buyer that traditionally purchases heifers stating that they are not purchasing in 2020 due to COVID-19.

- Documentation from applicant should include months, average number of heifers, and lost revenue from no/reduced sales.

If you apply now and do not receive your maximum allowed grant, you can amend your application once to demonstrate any additional economic harm you experience after submitting your initial application. Whether you apply a single time or submit one application and one amendment, all applications must be received by November 15, 2020.

Should I upload documents for all months listed in the application or just those months where I had a loss?

You only need to document your losses in the months for which you are claiming a loss. You also can only demonstrate your losses from March 1, 2020 through the date that you apply.

What if I expected to produce more in 2020 than I did in 2019?

Unfortunately, we are only able to determine losses by comparing 2020 production to 2019 production and are not able to determine reductions in anticipated increased production.

If I experienced losses since March 1, 2020 that are not specifically mentioned in the application, how do I apply for reimbursement?

The "Other Harm" section of the application offers an opportunity for a dairy business to capture additional income losses. You will need to explain your losses and upload the documents that demonstrate your loss in the 2020 month as compared to the same 2019 month. You may also be able to demonstrate your loss by contrasting your monthly revenue after February 2020 with your January or February 2020 revenue before the COVID-19 pandemic impacted the economy.

Can a dairy farmer also claim losses related to a pandemic-related drop in maple syrup prices under the same application?

Yes, if your dairy farm business also produces maple syrup under the same Taxpayer Identification Number (TIN). Each business can only receive a single state CRF grant, so your dairy business cannot also apply to other grant programs for its distinct business activities, but you may claim your additional business losses (maple, livestock, produce, etc.) that are related to the COVID-19-10 public health emergency in your dairy application. All losses and expenses will be limited to the maximum available dairy grant for your farm size.

What kind of documentation do I need to demonstrate my losses for bulk maple syrup that I was not able to sell?

First, you would need your sales receipts from each month since March 2020 when you are claiming losses. Second, your 2020 sales could be compared to your receipts from the same month(s) in 2019 to determine what you could have sold this year without the COVID-19 public health emergency.

Dairy Processors

I am a seasonal dairy processor who was not actively processing on March 1, 2020 but am actively processing now. Am I eligible for my pandemic-related losses and expenses?

Yes, if you were a processor licensed with the Agency of Agriculture on March 1, 2020. New dairy processing businesses that started after March 1, 2020 are not eligible for the Dairy Assistance Application. But, an existing seasonal processor that was “known” to the Agency of Agriculture on March 1 and is “currently” processing milk is eligible to apply for relief for their losses incurred since March 1. In other words, seasonal processors that were registered before the pandemic and are currently processing milk are eligible for the grant program.

Does aging a product count as processing?

Yes. However, dairy processors must have been known to the Agency of Agriculture on March 1, 2020 to be eligible for this grant program.

I am interested in starting a small cheese plant for direct-to-consumer sales because of a quota reduction related to the pandemic. Could the dairy grant fund this infrastructure investment?

The dairy assistance application provides reimbursements for incurred losses and necessary expenditures related to the public health emergency. Accordingly, eligible expenses must have been paid for at the time of application and be necessary business expenditures and related to the COVID-19 public health emergency.

Other Dairy Assistance Application Information

Is the Dairy Assistance Application available to organic dairy producers?

All dairy farmers that received a Unique Dairy ID Number (Farmer/Processor ID Number) are eligible to apply. The program is designed to reimburse dairy farms’ revenue losses and expenses that are due to the COVID-19 pandemic.

I have multiple farms and permits. Can I submit more than one application?

Each dairy farmer or processor is assessed by its farm or processing size known to the Agency of Agriculture as of March 1, 2020. Each farm or processor is eligible for one grant per permitted or licensed operation. So, multiple farm locations that operate under one LFO permit are eligible for a single grant. If farms or processors have multiple permits or licenses, they may submit one application per water quality permit designation or licensed processor size.

I have multiple farm locations operating under the same Medium Farm Operation (MFO) Permit. Can I submit more than one application?

No. An MFO with multiple locations under the same water quality permit may submit one application per permit.

I have multiple farm locations operating under the same Large Farm Operation (LFO) Permit. Can I submit more than one application?

No. An LFO with multiple locations under the same water quality permit may submit one application per permit.

My business has yet to fill out an application, does that impact my ability to claim September milk losses?

If you have yet to submit an application, you do not need to receive a message from VAAFM that your business is eligible. All dairy farmers who are either a) in the process of applying and have not yet submitted their application or, b) have received a supplemental application, can claim September milk revenue losses.

My business did not meet the cap on my initial application. Am I eligible to submit a second application?

If you are eligible to submit a second application, you will receive a message letting you know that you are eligible to do so. Please login to your original account with the same username and password. On your dashboard you will now see a new application which will have the status as “unsubmitted”. This application will have the edit option, indicated with a pencil icon; select this application to add in new information. There are three distinct areas where you can add new information regarding losses and expenses: the milk production table, the other economic harm section, and a value for duplicative payments.

How are subsequent Dairy Assistance Application submissions being managed in the Salesforce system?

If you are eligible to submit a supplemental Dairy Assistance application, you will receive an email message with details. This message will be sent to the email address associated with your registration. The deadline to submit a supplemental Dairy Assistance application will be November 15, 2020.

When is the deadline to submit a supplemental application?

Dairy producers and processors should submit initial or supplemental applications by October 1, 2020 to be guaranteed funding. Submitting an application means just that; the applicant needs to finalize and click "submit," not just have created an application and started to enter information. All applications submitted after October 1 will be will be considered on a first come, first served basis as long as funds remain available.

Contact Us

(802) 828-2430 select #9

AGR.CovidResponse@vermont.gov