Editor’s note: This brief is part of the Vermont Agriculture & Food System Plan 2021-2030 submitted to the legislature in January 2021. To read the full plan, please go to

Lead Author: Janice St. Onge, Flexible Capital Fund

Contributing Authors: Eric DeLuca, Leverage Point Consulting; Chelsea Bardot-Lewis, Vermont Community Foundation; Will Belongia, Vermont Community Loan Fund; Sam Smith, Intervale Center; David Lane, Yankee Farm Credit; Sarah Isham, Vermont Economic Development Authority, Vermont Agricultural Credit Corporation.

What’s At Stake?

Properly capitalized farms and food businesses are critical for a healthy food system. Food system businesses need different kinds of capital depending on their stage of growth, scale of operation, and the markets into which they sell. In part due to the aging of our population, Vermont is experiencing an unprecedented generational transfer of farmland and food businesses. We need to develop new business models, and support access to affordable farmland for new and beginning farmers and young entrepreneurs to take over food businesses, all of which require significant capital and business acumen for success. Critical to this process is connecting the next generation of values-driven investors with opportunities to support farms, food producers, and food system businesses, through a variety of capital provider organizations and through programs that educate new investors.

Current Conditions

Strengthening the state and regional food system is one of the most important paths for broad and sustainable wealth creation in rural communities, yet Vermont farm and food businesses are forced to rely on a more limited financing landscape than businesses in other sectors.

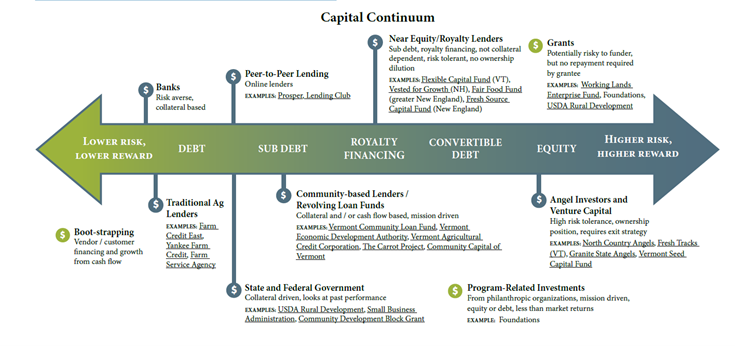

There is a deep interrelationship between matching the right kind of capital with the right capital structure and provider, as well as individuals and/or networks that can provide that capital.

Capital can take many forms, as shown in the capital continuum diagram. Financial capital can be structured as debt, equity, grants, and more. The maturity of different types of businesses within the food system can impact access to capital, as well as dictate the form of capital that

is most suitable. For instance, for food manufacturing businesses that are growing or pivoting their business and expanding facilities and/or distribution, there is often a lag time between when investments are made in a new facility or equipment and when revenues are generated from that investment. This leads to cash flow challenges as the business grows and requires additional working capital that is patient and flexible.

From 2008 - 2018, a suite of new and diverse forms of capital have become available to Vermont farm and food businesses. Alongside the growth in Yankee Farm Credit

and Vermont Agricultural Credit Corp (VACC) portfolio of loans over the last decade, new lending programs, such as the Vermont Community Loan Fund’s (VCLF) Food, Farms & Forest Fund, have been developed. The advent of crowdfunding, complemented by the changes to the Vermont Small Business Offering Exemption, have allowed food system businesses the ability to seek capital directly from individual investors. One example is Milk Money Vermont,

a platform for businesses to raise capital from Vermont investors in amounts and at a scale that are accessible to the full range of individual investors.

The Vermont Working Lands Enterprise Fund is another example of an important new source of capital, providing grant funding to strengthen and grow the businesses connected to Vermont’s working landscape. Since its inception in 2012, the Fund has distributed over $5.3 million to 184 agriculture and forestry projects.

Financing Farmland and Farms

Current Conditions

Demographics and market shifts are accelerating the pace of generational farm transitions. There are multiple costs when farms transition, including the farm land transfer, the transaction, and the start-up costs of the new farm. New and beginning farmers are attempting to access farmland on which to develop their businesses, but as the historic mechanisms of family inheritance and transferable dairy markets have become the rare exception, innovative lease-to-own models are emerging that enable incoming farmers to build equity and working capital while they grow markets and customers.

Bottlenecks & Gaps

• Some of the traditional agricultural capital providers are not yet knowledgeable about new

and diversified farming business models (e.g., grass-fed beef), and many have taken losses that might make them more risk averse in the future. Additionally, the methods of risk assessment commonly used by such capital providers cannot readily be applied to new models.

• Affordable land access is one of the biggest costs in starting and growing a farm business. The fact that Vermont’s new farmers often don’t have the equity and down payment needed to purchase land calls into question cultural assumptions that land ownership is the first step for a new farmer.

• When new farmers do purchase land early in the life of their business, they often struggle to have sufficient capital for operating expenses and capital expenditures to make improvements.

Opportunities

• Yankee Farm Credit is expanding their Young, Beginning, Small and Minority (YBSM) farmers program, which includes Farm Start, reduced underwriting criteria for YBSM, business consultation, and business education.

• Yankee Farm Credit partners with the Farm Service Agency (FSA) on the USDA Beginning Farmer program, requiring only a 5% down payment on real estate purchases.

• Both VACC and FSA offer low-cost real estate and operating loans to beginning farmers and on-farm value-added operations.

• The Vermont Land Trust’s Farmland Access Program, and newly launched Farmland Futures Fund (FFF), is an innovative, successful, and evolving tool for the transfer of farmland to the next generation.

Financing Food Businesses

Current Conditions

There are myriad lending programs supporting Vermont value-added food businesses. Companies with hard assets (e.g., equipment, real estate) are commonly able to finance early growth in small amounts through these sources of debt. As food system businesses scale and grow, they can be at risk of over-leveraging their business if they don’t grow as quickly as planned, or they can lack sufficient working capital and personnel to properly manage the growth.

Meanwhile, new and emerging businesses with high-growth-potential products (e.g., breweries, kombucha, CBD products) are seeing an influx of capital during their early stages of growth, but as they grow and need larger and more risk-focused capital, they are having a hard time raising it from in-state sources.

Bottlenecks & Gaps

• We need more educated, values-aligned, equity investors in Vermont that can bring sufficient amounts of capital to help businesses grow.

• Attention to succession planning and the requisite capital to facilitate a transition to new ownership is often brought up too late in the life cycle of the business.

• Few food system businesses have advisory boards or mentors to help them navigate the challenges of growing their business.

• There is a gap in flexible funding options for slower-growing, lower-margin food system businesses.

• There remains a lack of understanding of the sources of capital among food entrepreneurs.

Opportunities

• Businesses and projects in Vermont’s Opportunity Zones (OZ) may see better access to alternative sources of capital if the OZ attracts investor dollars.

• Writing case studies and sharing stories of failures in food system entrepreneurship can provide important lessons learned to entrepreneurs who are just starting out and would benefit from knowing they are not alone.

• Advisory boards can mitigate risk for entrepreneurs and investors, while insuring against executive burnout and enhancing growth strategies and access to markets.

• The Vermont Women’s Investor Network and the Northern New England Women’s Investors Network educate and engage female investors in support of female entrepreneurs.

Systemic Issues Impeding Food System Businesses’ Ability to Access Capital

Current Conditions

Capital providers tend to be siloed. If investors, lenders, grantmakers, bankers, and other types of capital providers built stronger ties across the capital continuum and outside of their traditional networks, they would have a wider choice of providers to bring to the table when an entrepreneur doesn’t fit their particular criteria or needs more than one type of capital to grow. The traditional investing model is lopsided and skewed towards investor gains (or protection from losses), as opposed to being a true partnership with entrepreneurs whereby all stakeholders’ interests are considered.

Bottlenecks & Gaps

• There are low-cost loans available to farm and food businesses but much of this debt remains dependent on collateral to get approved, which can be challenging for early-stage businesses.

• There are not enough diverse investors (e.g., women, people of color, Generation X, and millennials).

• Business assistance providers have varying levels of expertise and knowledge along the capital continuum, which could lead them to suggest a mismatch between businesses and capital providers.

• We have some mechanisms for helping low-income and underserved populations access capital, but typically in the form of small grants that are expensive to administer. Furthermore, these populations often lack access to social capital and advisory services.

Opportunities

• A significant transfer of wealth from baby boomers to millennials is underway. Millennials are more likely to value strong local food systems and community (see Consumer Demand brief), and are interested in alternative investment opportunities.

• Impact investing has gained traction among a wide range of investors, including the largest financial institutions, pension funds, family offices, private wealth managers, foundations, individuals, commercial banks, and development finance institutions. Impact investing refers to investments made into companies, organizations, and funds with the intention to generate a measurable, beneficial, social or environmental impact alongside a financial return.

Summary

Human and social capital are as important to food system businesses as financial capital. Having the right people and talent, networks, and connections is as critical as money to grow a business, and can assist with the transition of that business to new ownership when the time comes. Human capital is defined as the team that brings value to your organization. Social capital is the connections and shared values that exist between people and enable

cooperation. When a company has developed social capital, it is much easier to access other resources such as investors, recruiting experts, or building a team. Even if a company

is generating revenue and has a great team, without a network of supporters, the first bump along the way may send the company down a road they can’t recover from. The recommendations below offer ways to support entrepreneurs and their need for financial, human, and social capital.

Recommendations

• Provide at least $1.5 million in funding annually to the Working Lands Enterprise Fund. These grant funds are a unique and critical source of capital that leverage and accelerate innovation and sustainability in Vermont food system businesses.

• Work with public-private entities to explore the creation of an Agricultural Loan Loss Reserve Fund for businesses that need financing but lack collateral. Such a fund would serve as a guarantee in lieu of collateral, and only be drawn from upon loss of principal.

• Foster regional relationships across New England states to bring regional capital (financial, social, human) into Vermont for food system businesses (e.g., Northern New England Women’s Investors Network, New Hampshire and Maine Charitable Foundations). In particular, convene philanthropic, public, and private organizations to collaborate on solutions for farm-transfer financing (e.g., down payment on land, guarantees for farmers who provided owner financing, and lease-to-own models designed to address farmer needs and interests).

• Provide targeted education and outreach to main street investors (non-accredited) to build awareness of opportunities to invest in intermediary institutions, such as Community Development Financial Institutions (CDFIs) and credit unions who are lending to and/or investing in food system businesses.

• Revise the Vermont Training Program statute to enable funding for food system and working lands entrepreneurs who want to secure coaching and mentoring services (e.g., leadership and CEO/peer-to-peer mentoring). As businesses grow and scale, entrepreneurs and founders need the same support an incumbent worker may need to upgrade their skills.

• The Vermont State Treasurer should expand the focus of the state’s Local Investment Initiative to include investments that support a healthy food system in Vermont. Investments could be in the fixed income public markets, fixed income private debt markets, cash, and real assets. The Soil Wealth report provides guidance on investing in agriculture across asset classes.

• Explore what would be required to develop a college loan forgiveness program for aspiring farmers to make it easier for them to acquire land and start their farm.