Editor’s note: This brief is part of the Vermont Agriculture & Food System Plan 2021-2030 submitted to the legislature in January 2021. To read the full plan, please go to

This brief was prepared by:

Contributing Authors: Becka Warren, VSJF | Lawrence Miller, Founder, Otter Creek Brewing | Andrew Peterson, Peterson’s Quality Malts | Jen Kimmich, Alchemist Brewery | Geoffrey Sewake, Whirligig Brewery | Bob Grim, Foam Brewers | Melissa Corbin, Vermont Brewers Association | Ross Richards, Madison Brewing

What’s At Stake?

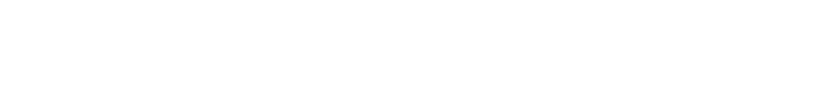

In 2019, Vermont’s 68 breweries had $366 million in economic impact. Vermont brewers capture international accolades and are a powerful force for Vermont’s food reputation, attracting consumers to Vermont-made beers and to the state itself for brewery tourism. In 2015, an estimated 1.2 million out-of-state brewery visits generated $50 million in non-bar/restaurant expenditures. Vermont brewers often highlight selected local ingredients in specialty brews and/or regularly source local ingredients, although there is room for growing these collaborations to the benefit of both breweries and farmers. Prior to the COVID-19 pandemic, the U.S. craft beer industry was experiencing saturation and declining demand. Vermont breweries were not exempt from that trend, and necessary pandemic restrictions are now threatening the survival of Vermont breweries of all sizes. Many breweries are creatively revisiting their business models, packaging, distribution, and marketing and sales strategy.

Current Conditions

Breweries play a vital role in the Vermont food system,

Breweries play a vital role in the Vermont food system,

impacting agriculture, tourism, the service economy,transportation and storage, manufacturers, wholesalers,and retailers. In 2019, there were 68 breweries in Vermont, employing 2,969 people and producing beer

for national distribution, local brew pubs, and the hospitality industry. Breweries are supporting the economic development of cities and towns by drawing considerable numbers of people to Vermont who spend in the surrounding community. In some cases, lack of adequate municipal infrastructure is restricting potential brewery development. Vermont brewers have increasingly integrated local agricultural products as they have become available and as consumer demand for local products has risen. Some brewers are using Vermont barley and wheat malted in-state, as well as Vermont hops, maple syrup, berries, apples, grapes and more (see Hops brief, Food-

Grade Grains brief). Barriers to integrating more farm products into a brewery supply chain can include lack of infrastructure and potential variability in quality and consistency of these agricultural products, as well as brewery’s business model.

At the onset of the COVID-19 pandemic, the Division of Liquor Control (DLC) permitted curbside pickup and delivery under the State of Emergency, which enabled breweries without extensive bottling and distribution infrastructure to remain in business. While the brewing industry has historically relied heavily on tourism dollars, local support during the pandemic illustrates that tourists are not the only ones supporting Vermont beer. That said, without the return of pre-pandemic levels of tourism, or some other form of economic relief, the brewing industry will see closures and a contraction in growth.

Bottlenecks & Gaps

• Managing the high biological oxygen demand (BOD) wastewater from breweries within the constraints of current town infrastructure and funding is a challenge for towns and breweries, affecting the growth of those breweries.

• The current permit and tax reporting requirements for Vermont breweries are a burden and include property taxes, 18 different monthly, quarterly, and yearly business taxes, and six different permits/licenses.

• The establishment and success of Vermont farm businesses which could provide beer inputs is constrained by a lack of infrastructure. This includes insufficient grain storage, malt and hops processing equipment and facilities, along with research and distribution infrastructure.

• Alcohol abuse is the third leading preventable cause of death in the US, causing approximately 360 deaths in Vermont annually. Alcohol abuse impacts the state as a whole as well as the brewery workforce, with state government contributing millions of dollars each year to prevention, education, and treatment.

Opportunities

• There is tremendous beer knowledge and innovation in Vermont, including UVM Extension staff and other technical advisors, out-of-state specialists, research academics, and master brewers.

• Assisting towns with ongoing needed investments in their wastewater systems would remove barriers to growth for industrial users including breweries and assist with economic development as well as state water quality goals.

• The DLC’s rapid shift to allow curbside pickup and delivery of beer during the COVID-19 pandemic demonstrated that innovative changes in the liquor laws were not harmful to the public and greatly benefit the industry as a whole.

• Breweries are working together to reduce their environmental impacts related to carbon footprint, energy consumption, recycling, and water usage and treatment.

• With focused investment and technical assistance, there is potential for Vermont farms to reap the benefits of Vermont brewery success and to build a barley farming and malting industry in Vermont.

Recommendations

• DLC should continue flexibility in the rules governing the sale and consumption of alcohol and consider other improvements and simplifications of distribution rules. Flexible rules, including those related to direct-to-consumer sales and outside consumption for on-premise establishments, will be critical to many breweries’ survival.

• State and federal funds are needed to assist towns with improvements in their wastewater systems, to aid in economic development, assist in water quality efforts, and remove barriers to growth for commercial and industrial users including breweries. The state also could pass legislation that encourages towns and cities to require equitable governance structures

during the consideration of water and wastewater rate changes, engaging stakeholders in the decision-making process.

• Revise state excise taxes for simplicity, efficiency, and reduced burden on small businesses. Provide an exemption for small breweries to account for and pay to the State of Vermont the unclaimed $0.05 deposits on containers collected at the point of sale. Managing redeemable containers is a real cost to Vermont’s breweries that sell direct to customers.

• Reinvest alcohol tax dollars into the Vermont beer sector and related industries, as well as substance abuse programs. Some funds could go back directly to farmers producing hops and grains, which would help level the playing field so they could produce at competitive prices. Other funds could support research, infrastructure development, the Vermont Brewers Association, and community-based and statewide substance abuse programs.

• Invest in infrastructure. For edible grain production to expand to meet the potential demand from Vermont breweries, there needs to be additional equipment and infrastructure in Vermont for growing and processing, strong regional markets, access to capital, and research-based technical assistance (see Food-Grade Grains brief).