By Mark Canella, UVM Extension

In winter 2021 a survey of Medium Farm Operations (MFOs) and Large Farm Operations (LFOs) was conducted in Vermont. The goal of this survey is to gather information on the economic situation across Vermont’s medium-to-larger farms, explore their adaptation to Required Agricultural Practices (RAPs) and to understand the next steps for farms moving forward. The anonymous survey was distributed to all registered MFO and LFO farm business owners through postal mail and final returns resulted in a 44% response rate, equating to 62 complete survey responses. A similar survey had been conducted for Certified Small Farm Operations (CSFOs) in 2019.

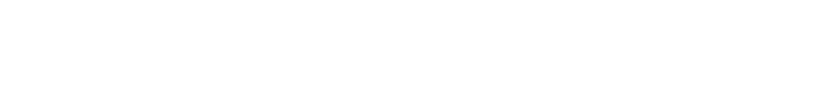

The recent survey shows that conservation practice adoption and compliance is widespread among MFOs and LFOs in Vermont. These farms have made changes and investments since the new regulations and Required Agricultural Practices were enacted five years ago. The largest compliance factor this group of farms continues to address is silage leachate and feed storage.

Figure 1: Percentage of MFO-LFO farms self-reported as in compliance for five major features on the farm

Very few MFO and LFO owners were unsure if their farm is in compliance for particular categories, less than 2%. This is much fewer than CSFO owners in 2019, where an average of 10% of owners were “unsure” about compliance across five major farm features.

This is likely due to the larger farms having many more years of experience with Vermont Agency of Agriculture, Food & Markets oversight and more routine inspections: every 1 year for LFOs and every 3 years for MFOs, as compared to every 7 years for CSFOs.

The recent survey also showed a higher degree of familiarity with conservation among MFO and LFO owners in 2021 compared to CSFO owners in 2019. Only three percent (3%) of MFO and LFO respondents say they are “not familiar” with conservation programs, compared to twenty-eight percent (28%) of CSFOs.

Shared challenges impact the business viability of all farms in Vermont. In the two identical surveys the MFO and LFO group and the CSFO group both indicated the same top three challenges: short-term profitability; lack of capital for investment; and labor-employee concerns. Within the MFO and LFO group, however, a higher percentage of farms indicated these challenges (short term profitability 95% MFO-LFO vs 83% CSFO, lack of capital 87% MFO-LFO vs. 80% CSFO, labor-employee concerns 85% MFO-LFO vs. 67% CSFO). Thus, these larger farms are shown to experience each of these challenges at a higher rate compared to smaller farms in Vermont.

That said, medium and large farms in 2021 indicated stronger short and mid-term staying power compared to certified small farms, and more confidence in their business outlook over the next five years. Over 40% of CSFOs in 2019 were likely to consider an exit or business wind-down over the next five years, compared to 10% of responding MFOs and LFOs in 2021. The dramatic 20 % drop in the number of registered dairy farms in Vermont from 677 in 2019 to 544 was primarily driven by the departure of small farms, which confirms the trend that had been anticipated in the 2019 CSFO survey.

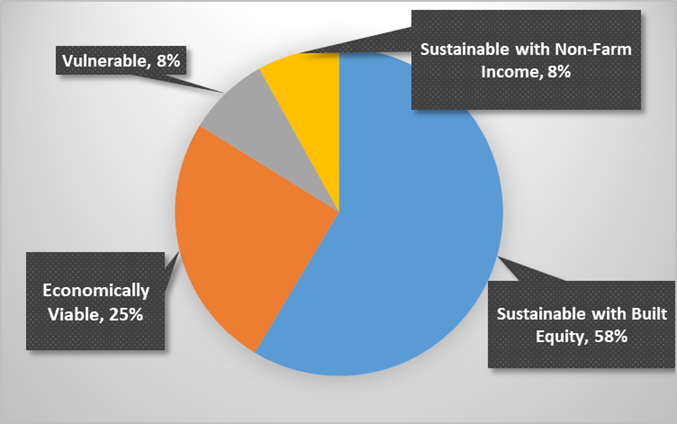

MFOs and LFOs also indicated they are more likely than CSFOs to consider growth: expanding their enterprise, renting additional farm land and purchasing more land in the next five years. In addition, roughly 58% of MFO-LFO farms indicate their business is “Sustainable with [access to] Built Equity”, 25% define themselves as “Economically Viable and only 8% define themselves as “Vulnerable”. In comparison, in the 2019 CSFO survey 20% of respondents defined themselves as “Vulnerable”[MC1]

Figure 2: Percentage of respondents in each self-assessed category of business viability

Although these results indicate that MFOs and LFOs are confident in their short- and mid-term staying power, it shows that these operations are heavily reliant on built equity to maintain farm viability when they are unable to generate annual profitsBuilt equity will always be challenged by the depth or duration of market disruptions and downturns. Therefore, capital access and sustained repayment capacity will continue to be an important feature of MFO and LFO viability in Vermont.

Although fifty-four percent (54%) of MFO and LFO farms have a succession plan in place, owners of these businesses still indicate that farm succession services and resources would help their farm planning. Furthermore, succession planning resources and services are cited as the program offering that would be helpful to the greatest number of MFO and LFO owners compared to other programs presented in the survey. While the presence of transfer plans is a good indicator of preparedness, the desire for more services reflects the complexity or magnitude of the business factors that continue to need attention for medium and large farms.

Vermont’s MFO and LFO farms have a significant footprint on the Vermont working landscape. Many would argue they have or had potentially the most to lose when new water quality regulations went into effect in Vermont. However, roughly five years later one sees a high level of compliance with the RAPs and an indication that this group of farms is prepared to continue farming in Vermont for years to come. The full report “Conservation and Farm Viability on Vermont Medium and Large Farms” is available online at: https://scholarworks.uvm.edu/extfac/20/ .

Mark Cannella and the rest of the UVM Extension Agricultural Business team deliver one-to-one, small group and online learning opportunities that enhance decision-making and viability on farms. If you are interested in accessing UVM’s support to improve your farm business, contact Mark at Mark.Cannella@uvm.edu or 802-476-2003.