June 2022 - Editor’s note: This brief is part of the Vermont Agriculture & Food System Plan 2021-2030 submitted to the legislature in January 2021. To read the full plan, please go to

Lead Author: Eliza Leeper, Vermont Creamery

Contributing Authors: Adeline Druart, Vermont Creamery; Miles Hooper, Ayers Brook Goat Dairy; Tom Bivins, formerly of the Vermont Cheese Council; Kari Bradley, Hunger Mountain Food Co-Op; Shirley Richardson, formerly of Vermont Chevon

What’s At Stake?

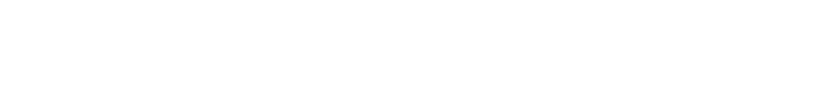

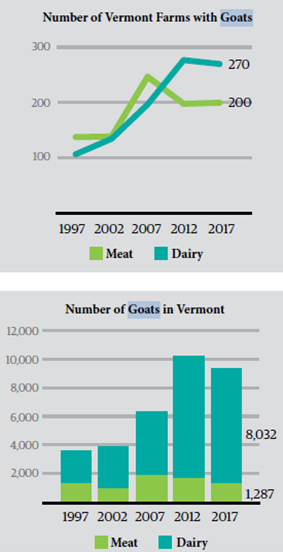

Vermont has driven growth in the artisanal cheese industry over the last 40 years. Today there are a dozen Vermont goat cheese brands, including the number two national brand of retail goat cheese. Due to the success of Vermont goat cheese makers, an estimated 5,000 additional milking goats could be needed in the state. In parallel to the goat dairy industry, the goat meat industry is still in development but has strong potential with both general and immigrant consumer markets.

The goat industry represents a diversification opportunity for cow dairy operations, potentially contributing to keeping farms in business as well as maintaining a vibrant agriculture landscape in Vermont.

Current Conditions

Vermont’s goat milk production has grown from 2 million

Vermont’s goat milk production has grown from 2 million

pounds to almost 3 million pounds over the past five years.

The demand for Vermont goat milk is larger than current

state production, resulting in an out-of-state supply strategy

from major Vermont cheesemakers. Vermont Creamery

anticipates processing approximately 25 million pounds of

goat milk per year by 2024, a meaningful opportunity for

the state’s dairy farming industry. Other prominent Vermont

cheesemakers have taken interest in the goat cheese industry

(e.g., the Cellars at Jasper Hill).

Goats generate income for a farm within 12-15 months, and give birth to females more often than cow reproduction, enabling a quick growth of the herd and improvement of genetics. Less cash is required to set up an efficient goat dairy than an efficient cow dairy. Labor costs are higher for goat dairies than cow dairies, however the work itself can be less arduous. Goat meat also shows promise nationally, with about 2.5 million goats being raised for meat in the U.S. currently, and a need for up to 750,000 additional goats per year in order to meet national demand. Vermont can become a leading state for goat farming by increasing the availability of technical assistance and production expertise, improving marketing support for the industry, communicating the opportunity to meet growing demand, and ensuring access to financing for new and existing goat farms.

Bottlenecks & Gaps

• There is a lack of dedicated resources and knowledge about goat dairies and a corresponding shortage of targeted outreach on opportunities that exist in the goat dairy market.

• There is a lack of capital for on-farm diversification for farmers interested in adding goats.

• There is an insufficient level of support services in the Vermont goat industry (e.g., vets, feed consultants), especially regarding nutrition, genetics, and best husbandry practices.

• As the goat dairy industry grows, there is a need to further develop a market for goat bucklings (male kid goats) which are a by-product of dairy operations.

• The goat meat market faces a lack of consumer and chef awareness, as well as inefficient slaughter and processing infrastructure.

Opportunities

• Existing cheese processor demand could support at least ten new goat dairy farms of 400+ goats (the viable threshold for farm size).

• Farmers can diversify cow dairies by retrofitting milking parlors for goats.

• Growing demand for goat meat represents an additional market for farms as they grow their goat

dairy operation. Current national demand leads to 52% of goat meat being imported from Australia and New Zealand.

• Additional consumer sampling, recipes, and cooking education regarding low fat, lean goat meat could be done through restaurant and retail partnerships.

• Local retailers see an opportunity for increased value-added products for retail to be further developed, such as goat yogurts, gelato, caramel, butter, ice cream, buttermilk, skyr, and jerky.

Recommendations

• Create a “Center of Excellence” with an on-site farm in Vermont to support growth of the goat farming industry and build expertise. Vermont Technical College has expressed interest in exploring this opportunity. This leadership could be a model for other states interested in farm diversification and keeping agricultural land in production. The first step is to explore the cost of creating such a Center.

• Offer financial support (a combination of low-interest loans and grants) for on-farm diversification that includes goats, in order to support the costs related to infrastructure, cash flow, and herd transition. A process to pair investors with farmers in search of capital could be mutually beneficial. The overall cost is approximately $400,000 to diversify a cow dairy to include goats. The cost of a new milking parlor is $150,000, the cost of 400 goats is $160,000. (Total cost to get to ten 400-goat farms is $4 million.)

• UVM Extension should create a staff position focused on goat farming to coordinate farm development efforts within the state and create resources to share with farmers interested in diversifying to goat dairy production. Cost: $100,000 per year.

• The Vermont Agency of Agriculture, Food and Markets could assist in developing marketing materials for goat meat as well as consumer and chef education through training and sampling, and the facilitation of restaurant and retail partnerships.