BEGAP Program | Frequently Asked Questions - Updated 8/28/2024

Q. Will this program cover hay and crop losses?

A. Yes, this program covers physical damage including hay and crop losses.

Q. What are the physical damage categories?

A. BEGAP applicants will be asked to estimate physical damages and losses across multiple categories:

- Real Estate: Includes damage and losses to infrastructure AND land. This includes buildings and damage to fields.

- Inventory: Includes damage and losses to crops, feed, and livestock

- Machinery: Includes tractors, mowers, planters, etc.

- Equipment: Includes refrigerators, washing stations, bulk tanks

Q. Is my pastureland that was damaged by the flood (silt, debris, excessive moisture) eligible?

A. Yes, this may be considered damage to land (Real Estate) and/or damage to crop/feed (Inventory). In the application you could include costs to repair the land and/or costs to replace the lost feed or to access additional pastureland.

Q. My cropland was not flooded but the amount of rain in July has made it impossible for me to take a crop off. I will not have enough feed for my animals this season. Can I apply under this program?

A. Yes, crop and feed loss due to the severe weather and saturated soils is an eligible property damage or loss associated with this program.

Q. I am not sure what type of federal funding assistance or grants I will receive, or what my total insurance coverage will be at this time, how should I estimate my net uncovered losses?

A. This is an opportunity to give your best estimate. If you have had some conversations with your insurance agent or adjuster, please offer that estimate. If you haven't received any other grants or loans or federal program assistance, you do not need to deduct anything additional from your total net damages.

Q. I operate an on-farm creamery, where our products are all produced from the farm. Should I apply under the ‘agricultural’ sector or ‘retail’, or ‘manufacturing’?

A. Apply under the ‘agricultural’ sector. Food and farm businesses, organizations, or individuals who raise animals and/or grow food or crops for sale, or who operate on-farm processing operations that have experienced physical damage due to the flooding event should apply as an “agriculture” sector with the Agency of Agriculture. If you have a food processing or food manufacturing business that is not principally your farm products, or if it is organized as a separate business located at a separate location/address, you may submit an application for that business under the ‘retail’ or ‘manufacturing’ sector with ACCD.

Q. I am a sugarmaker that had damage to my roads to access my sugarbush. Am I eligible for these funds and should I apply under ‘agriculture’ with the Agency of Agriculture or another sector, like ‘manufacturing’ with ACCD?

A. Sap collection and the production of maple syrup on your farm is considered agriculture. Therefore, if you have incurred land or infrastructure damage related to your sap collection, this would apply under the ‘agriculture’ sector with the Agency of Agriculture. Additionally, if your business processes sap that is principally produced at your operation, into maple syrup, any losses and damage related to your sugarhouse would also be eligible to apply under the ‘agriculture’ sector with the Agency of Agriculture.

Q. As a result of this wet growing season, I am making production planning decisions that will reduce my income this year into next. Plus I know that my feed and transportation costs will be higher going into winter. Can I apply for this program to cover these anticipated losses/increased costs?

A. No, this program does not cover anticipated revenue loss as part of the net total uncovered damages payment. This is considered “Economic Injury”. By the time of your application submission, if you have lost feed or are unable to harvest crops, those losses are eligible.

Q. What is acceptable documentation to show my real estate, machinery or equipment, inventory, or leasehold improvement losses?

A. Documentation must be included in your application describing your lost property types and demonstrating how you estimated your loss. Documentation may be a summary spreadsheet of items lost, quantity, and associated value, a quote for repair or replacement, and/or estimated repair/replacement budgets. For 2023 BEGAP applications submitted in this round, it is a requirement that all justification documentation be submitted as part of your initial application. Additional materials cannot be subsequently submitted. For 2024 BEGAP applications submitted, it is advisable to submit the most complete application possible. As applications are reviewed, if information is missing or needs clarification your application will be returned to you as ‘incomplete’ with directions of what additional documentation or information is needed.

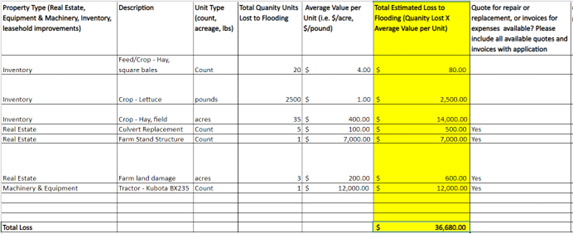

Below are examples of acceptable documentation for each loss category:

- Real Estate: Quote for repair or replacement, estimated budget of repair materials, labor, or contractor costs, or invoices of actual paid expenses.

- Machinery & Equipment: Quote for repair or replacement, estimated budget of repair or replacement, or invoices of actual paid expenses.

- Inventory: Summary of crop type, quantity, and value of loss. This may be calculated by previous crop year records or this years’ estimated value of crop type and crop yield/acre x acres lost or cost/inventory x inventory lost (quantity and value of crop lost).

An example of a summary spreadsheet of losses may look like:

Q. How will I know if my application is accepted and I will receive an award?

A. You will receive an email notification from ACCD about your application status.

Q. I am a Individual/Sole Proprietor/Single Member LLC, should I use my SSN or my EIN on my W9?

A. According to guidance provided by the tax department, if the business tax classification in Box 3 is “individual/sole proprietor/single member LLC” the Taxpayer Identification Number provided in Part 1 must be the SSN and must match the SSN in the applicant’s tax return. In this case, since your business is an individual/sole proprietor/single member LLC, tax and grant guidelines require that you only use your social security number on the W-9.

Q. Will my BEGAP award be considered taxable income?

A. Yes, you will need to claim this as income in your tax return.