Editor’s note: This brief is part of the Vermont Agriculture & Food System Plan 2021-2030 submitted to the legislature in January 2021. To read the full plan, please go to

Lead Author: Kyle Harris, VT Agency of Agriculture, Food & Markets

Contributing Authors: Sam Smith, Intervale Center; Bruce Hennessey, Maple Wind Farm; Rob Litch, Misty Knoll Farm

What’s At Stake?

The United States poultry meat industry is one of the most concentrated in the food system, with four poultry companies controlling 60% of the market. Vermont’s poultry meat producers compete against industrial poultry prices, and consumer price tolerance is a limit for growth in this field, especially for organic poultry (given high organic feed costs). Added production costs, spatial limitations, and slaughtering considerations present a challenge for Vermont poultry farms

who wish to scale up production to meet customer demand beyond their limited direct markets. However, poultry is an enterprise that could pivot with relative ease and help fill gaps in national supply chains as food system vulnerabilities become apparent due to the COVID-19 pandemic. Collaboration between producers, processors, lawmakers, and policymakers is needed to take advantage of these gaps, close grey areas in packaging claims, and get Vermont’s small-scale poultry producers into regional and metropolitan markets.

Current Conditions

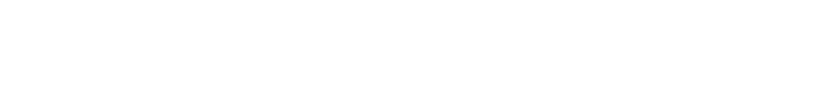

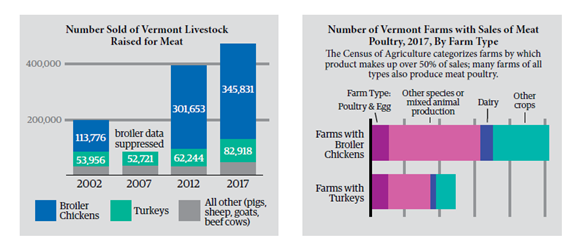

Vermont has approximately 300 meat poultry producers. They produce over 400,000 birds per year, typically raising birds from early spring to late fall. Poultry is often one of many enterprises on diversified farm operations, due to the low cost of set-up and the quick turnaround on a salable product.

Vermont has two state-inspected and four USDA-inspected on-farm poultry slaughter and processing facilities (USDA inspection is required to sell across state lines). Five of these facilities slaughter only poultry they have raised, while one offers services to other producers. All other Vermont poultry is slaughtered on-farm with an exemption from state inspection, which restricts how and where birds can be sold, and limits slaughter to under 1,000 birds annually.

Over the last decade, and especially after the COVID-19 pandemic, consumers have become increasingly willing to pay a premium to food products that prioritize humane animal practices, environmental considerations, and transparent production claims. Unfortunately, most Vermont producers processing with an on-farm inspection exemption, who could take advantage of this

consumer trend, can only sell birds whole and only on-farm, at local farmers markets, or to local restaurants. Small producers can take their birds to a licensed facility in order to have them processed into specific cuts, but as mentioned above, only one Vermont facility offers this service. On-farm licensed facilities with the ability to process birds raised on other farms struggle with the choice of triggering stricter labor requirements or supporting the success of small poultry operations.

Bottlenecks & Gaps

• Feed costs, lack of affordable or appropriately scaled infrastructure, and limited technical assistance make it challenging to scale up production.

• Finding people to work at a wage that makes sense for producers, processors, and hired labor can be challenging.

• Once a producer begins providing slaughter and processing services for birds raised off their farm to other farmers, their facility loses an exemption to federal labor laws, changing the payment structure of overtime for agricultural workers and impacting their business model.

• Values-based product certifications like “pasture-raised” have been exploited by large industrial poultry operations that follow only the bare-minimum requirements, making it difficult for Vermont producers who are committed to the spirit of these practices to sell competitively.

• Consumers are accustomed to purchasing poultry cuts rather than whole birds, which presents challenges for small producers who choose to process their poultry on-farm under the exemption.

Opportunities

• Consumer trends are supportive of the production practices and values of Vermont’s poultry producers. Consumers are looking for lean proteins and other nutrient-dense foods that fit their particular dietary wants and needs.

• Poultry meat and products are consumer favorites, food industry mainstays, and protein powerhouses, even with the recent explosion of plant-based protein alternatives.

• Vermont has approximately 290 poultry producers raising 1,000 or fewer birds and using the on-farm slaughter exemption. If these producers formed an association, it could assist them with peer-to-peer learning, policy advocacy, marketing, industry expansion, and other needs.

• During the COVID-19 pandemic, Vermont meat sales significantly increased. As health and climate crises are expected to continue, it is likely that consumers will continue to seek a reliable, local, poultry meat supply.

Recommendations

• One additional full-time business and technical assistance advisor specializing in small animal livestock production is needed at UVM Extension. The advisor would provide production assistance for poultry operations and other agribusinesses on breeds, nutrition, animal health, incubation rates, biosecurity practices, and regional and national market access. Cost: $100,000 annually.

• Vermont’s federal delegation should work with the U.S. Department of Labor to adjust overtime rules at processing facilities. Include an exemption authorizing straight time paid to workers for overtime due to processing birds raised off-farm, when that service remains supplemental to the facility business model.

• Funding should be allocated to assist Vermont’s poultry farmers in re-forming a producer association to serve the interests of small poultry producers. The association might create values-based marketing and packaging resources for poultry operations to utilize, assist in member-to-member engagement and consumer education, and be an advocate for Vermont’s poultry farmers.

• Industrial poultry operations often do the bare minimum to meet USDA values-based packaging claim requirements. The Vermont Agency of Agriculture, Food & Markets should work with Vermont’s federal delegation to suggest tighter requirements and bring more transparency to packaging claim regulations for all poultry producers.