Editor’s note: This brief is part of the Vermont Agriculture & Food System Plan 2021-2030 submitted to the legislature in January 2021. To read the full plan, please go to

Lead Author: Rose Wilson, Rose Wilson Consulting

Contributing Authors: John Ryan, Castanea Foundation; Kelly Nottermann, Vermont Sustainable Jobs Funds; Heather Pelham, Vermont Department of Tourism and Marketing; | Amy Trubek, University of Vermont Farmers to You; Jean Hamilton, Consultant; Beth Holtzman, University of Vermont | Annie Harlow, F2P Retail Consultant

What’s At Stake?

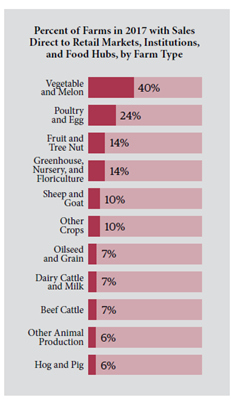

Over the past 20 years, the local food category evolved from an emerging to a maturing market. In a mature market, the rate of growth for the category slows, and while the overall size of the category is larger, increased competition threatens individual market share. This requires enterprises, in this case Vermont farms and food producers, to invest in more strategic, responsive marketing or be left behind. To address these challenges, local food producers must become proficient in leveraging their “marketing mix” to drive sales. A “marketing mix” is defined by marketing professionals as the seven P’s: product, price, place, promotion, people, processes, and physical evidence.

Current Conditions

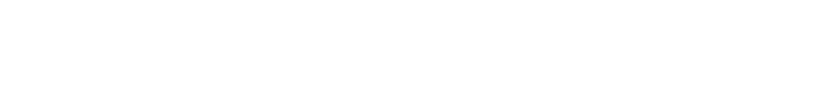

Over the past 20 years, with the exception of fluid milk and a few value-added products, Vermont-produced food has been shifting from primarily direct-to-consumer sales (e.g., farmers markets and community supported agriculture) to direct-to retail sales (e.g., self-delivery to stores and restaurants) and distributor-serviced wholesale. As demand for “local” food has grown, so has the number of producers striving to fulfill this need. This has led to reduced market share for many, the outright demise of several, and expansion and consolidation for a few. To succeed in this environment producers need to be nimble and business-savvy, and invest in marketing.

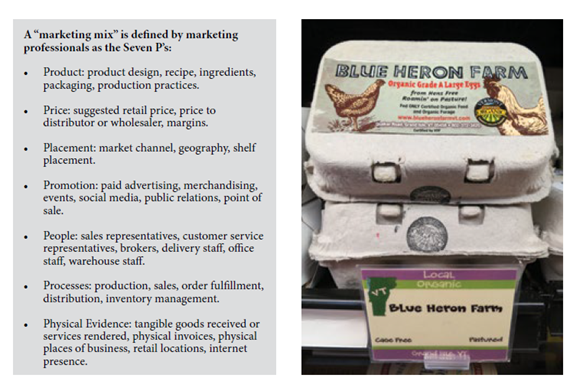

In a direct-to-consumer setting, producers are often interacting with the consumer and can “sell” the product, tell their story, and develop a personal relationship. This direct relationship is a powerful marketing tool and can simplify the marketing mix, requiring primarily an investment in human capital. In retail and distribution sales, the producer and end user become distanced from one another. This distance requires the producer to augment relational marketing with marketing mix tactics that support the product’s ability to sell itself (e.g., an eye-catching label, price, and packaging), as well as promotion to build brand awareness (e.g., paid advertising and a strong online presence.)

|

“We aren’t looking for new vendors so much as expanding the volume from current vendors. If you want to come knocking on my door what’s your niche – what’s your in? I’ve already got all these other growers. What do you bring that they don’t have?” - Nathan Daniels, Produce Purchaser New England, Albert’s.

|

Product, Price, and Promotion

Current Conditions

“Local” is a product feature. As this feature becomes ubiquitous, its value decreases. Local food producers increasingly need to innovate, be it expanding product lines or adding value with new production methods (e.g., “gluten-free”), to extend premium, product, and brand life cycle. Producers can also become more efficient to absorb downward price pressure. However, the cost of production in Vermont remains higher than in many parts of the country even as many Vermont producers strive for optimal efficiency.

Bottlenecks & Gaps

• Investing in promotion and branding is essential to building brand loyalty and price resiliency, but

adds time and expense.

• Regional aggregators, distributors, and retail chains may each have different standard specifications for products and producers.

• Retail product placement will impact sales velocity and may increase marketing costs.

• Promotion and branding costs can compound the price discrepancy for Vermont producers

competing in price-driven wholesale environments.

Opportunities

• Brand audits can help producers identify opportunities to refine their message, product, promotion, and packaging to better achieve their sales goals.

• Guerilla marketing tactics (i.e., using surprise and/or unconventional interactions) can be an

affordable way to establish direct contact with customers.

• Producers who do not have the time, inclination, or interest in doing their own marketing to

achieve their sales goals can hire marketing professionals.

Placement

Current Conditions

Whether it be attending a sufficiently populated farmers market, gaining placement into a particular retail store or distributor catalog, or getting placed at eye level on a shelf, placement can be a determining factor in a product or brand’s longevity because placement directly correlates to market access and sales velocity. Increasingly, producers, retailers, and distributors are expressing market saturation and recommend a producer have something new, unique, or different to offer, or be able to succinctly express why they are better than the buyer’s current supplier. 171have something new, unique, or different to offer, or be able to succinctly express why they are better than the buyer’s current supplier.

Bottlenecks & Gaps

• Direct sales locations may be self-limiting regardless of costly marketing investments (e.g, a roadside stand on a remote dirt road).

• Producers may need to invest in a broker to gain a retail buyer’s attention. Brokers can be expensive and may limit who they work with.

• Direct-to-retail and distributor-to-retail sales add distribution costs and logistics, which can be

complex and require new skills and knowledge (see Distribution brief).

Opportunities

• In a direct-to-consumer channel, incorporating entertainment and recreation can be a successful

placement improvement.

• Creative point-of-sale and packaging materials can attract attention to a product even if

placement is poor.

• Marketing that explains what makes a product truly unique can assist with placement barriers.

• Being first to market with opportunities or filling gaps that exist in the market has been a successful tactic for Vermont producers.

People, Processes, and Physical Evidence

Current Conditions

Having the people, processes, and physical evidence in place to support sales helps establish a competitive edge. People include everyone from production to sales and marketing, office staff, management, and supply chain partners. Processes include standard operating procedures, safety protocols, training manuals, and a written business, sales, and marketing plan. The people and processes ensure an efficient, well managed operation which leads to repeatable customer experiences. Physical evidence such as the curb appeal of a front office or production facility, the presence of a website, or the tactile nature of a printed invoice lend credibility. These all build consumer and/or buyer confidence.

Bottlenecks & Gaps

• Investing in adequate people and processes to support the needs of the business and meet

the needs of the customers can often be cost prohibitive, exceeding the producers’ profitability

during growth periods and even at scale.

• Often producers do not tie marketing strategies and budget to measurable goals and objectives,

measure performance regularly to assess impact, or update the plan as needed following review and analysis.

Opportunities

• Certifications such as Good Agricultural Practices (GAP), Good Manufacturing Practices

(GMP), and Hazard Analysis Critical Control Point (HACCP) may help producers access new

markets.

• When businesses create and adhere to written standard operating procedures, it can improve

employee retention, employee training, production efficiency, product quality, owner

stress, and customer relations.

• The Farm to Plate Producer-Distributor Database is a process-driven tool that can introduce local

producers to retailers and distributors.

Summary

With market saturation at every level from farmers markets to retail settings, local producers must increasingly invest in their marketing mix—product, price, promotion, place, people, process, and physical evidence—to survive and thrive.

Recommendations

• Provide annual funding for marketing and graphic design consultants to assist Vermont producers with messaging, branding, packaging, point of sale, and social media. Cost: $50,000 per year, 10 producers annually.

• Provide $500,000 in annual state funding for a collaborative statewide marketing and consumer messaging campaign focusing on buy local, direct-to-consumer sales, and reinforcing the value in the premium paid for local products. “Get Cultured in Vermont” (a collaboration between the Vermont Department of Tourism and Cabot Cheese) is an example.

• Provide grants for local food producers and service providers to attend national sales and marketing industry events, such as the Natural and Specialty Foods Sales Manager seminar. This will increase exposure to industry norms and trends, and help attendees engage with regional and national buyers, distributors, brokers, senior management, and industry professionals. Cost: $5,000 per year.

• Develop a technical assistance and mentorship program focused on the seven P’s of marketing: Product, Price, Promotion, Placement, People, Processes, and Physical Evidence. Content should include cost of production, margins, market channels, distribution, brokers and contract sales, branding, push and pull marketing, customer service, customer retention, and consumer confidence. Program should be a cohort model, to foster peer-to-peer engagement. An existing Vermont technical assistance provider could adopt such a program, with additional funding from the Working Lands Enterprise Initiative or other state funding opportunity. Estimated cost: $25,000

per year, 15 producers annually.

• Create three Vermont marketing broker positions to develop the regional market for a strategic catalog of Vermont products. The brokers would pilot a three-year program, identifying and developing top market channel opportunities within three target urban centers in the northeast. Cost: $600,000 over three years.